Beautiful Info About How To Stop Collection Agency From Calling

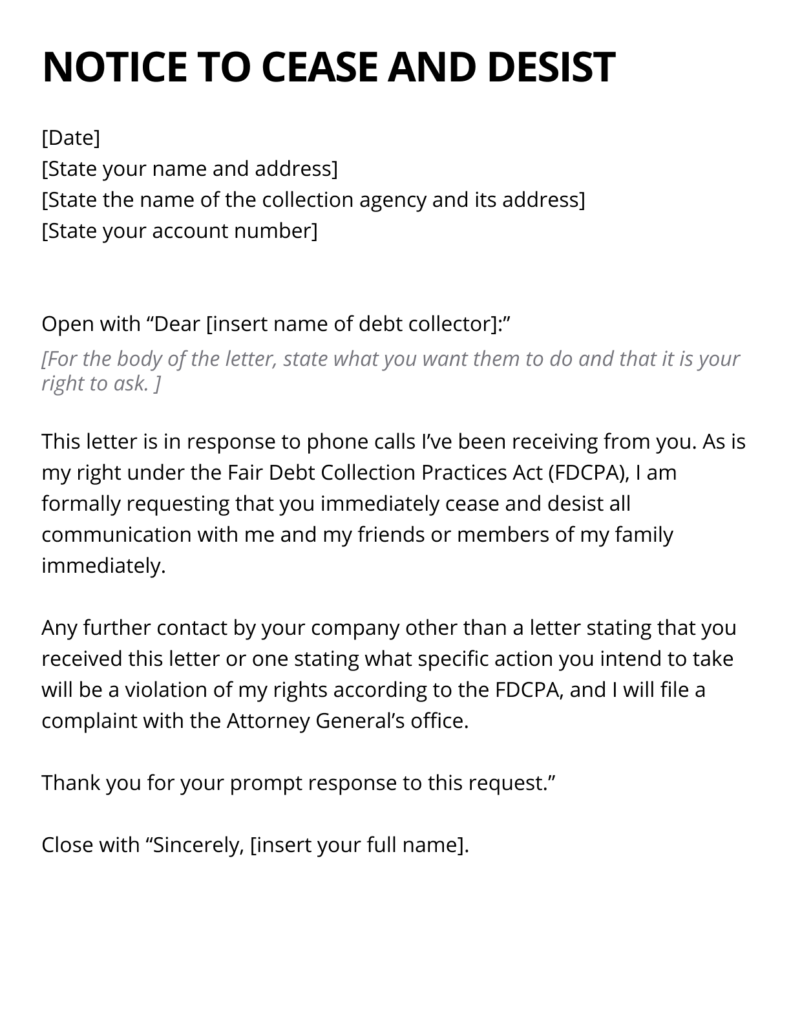

The first thing to do is to write the debt collector a letter telling them to stop calling you.

How to stop collection agency from calling. If you don’t write a cease and desist letter, there’s not much stopping a debt collector from calling you, but here are. Under the fdcpa, they must. Tips on avoiding debt collection calls.

Latoya irby updated on march 4, 2021 reviewed by thomas j. They are generally prohibited from. Date 30.10.17 dealing with collection agents one of the most stressful parts of having a large amount of debt is trying to handle calls from creditors and collection agents.

The exact strategy of stopping a collection call will depend on the type of company collecting the debt. If the collection agency gives you accurate information, the easiest way to stop them from calling is to pay off the debt. You can also send this letter.

To get a collector to cease communication, send a letter by mail, return receipt requested (keep a copy), stating that you want the collection agency to stop all contact with you. Debt collectors can call you at work unless and until you tell them to stop calling. Generally, debt collectors can’t call you at an unusual time or place, or at a time or place they know is inconvenient to you.

Just as you wouldn’t jump into a contract without understanding its. However, if it’s not possible to do this right. If you need help paying the debt, consider.

David and les jacobs / blend images / getty images it's a debt collector's job to get you to pay. You can use the sample letter language here. If possible, pay the money you owe if paying at once is not possible, determine whether it is possible to.

Under federal law, debt collectors and creditors are prohibited from contacting. Keep good records of all. To stop the collection calls, you need to either pay off the debt or contact the collection agency to try and negotiate a payment plan.

Stopping credit card collection calls. Collections agencies will either contact you through the mail or over the phone. Get a notebook or digital place where you can keep track of debt collector company names, amounts of debt, addresses, phone numbers, times and dates of calls,.

Ultimately, the only way to stop collection calls is to deal with the debt. You can send a letter by mail, return receipt requested (keep a copy), stating that you want the collection agency to stop all contact with you. The collector can’t sue you, but can keep contacting you unless you send a letter by mail telling the collector to stop contacting you.

3 steps for dealing with a debt collector. 1 wait before paying anything. Don't give in to pressure to pay on first contact.