Build A Tips About How To Reduce Finance Charges

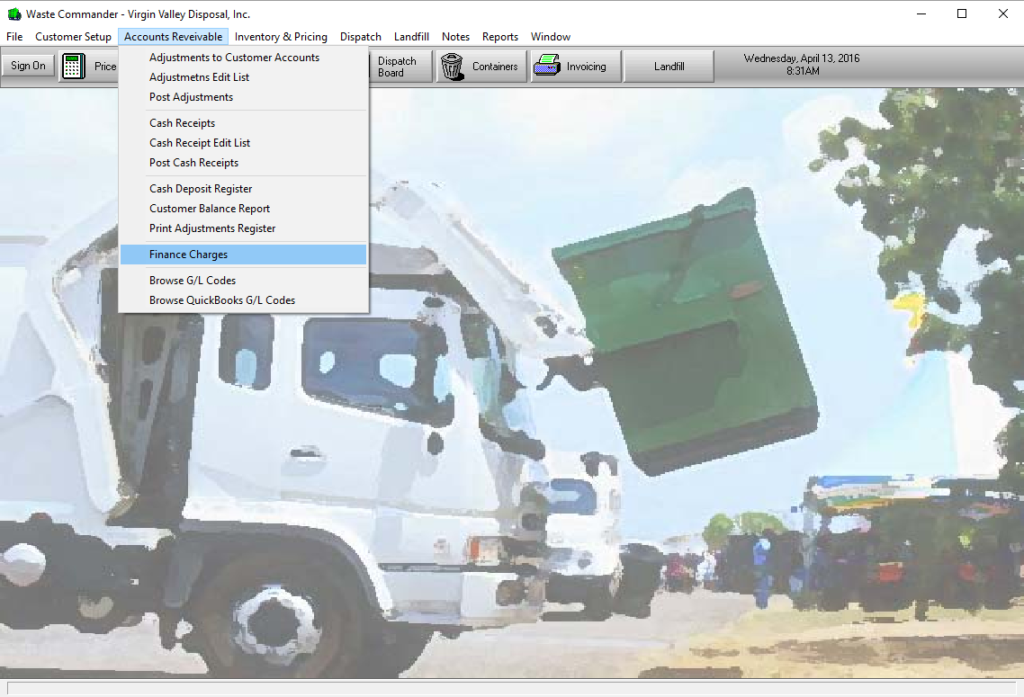

Now that we have discussed what finance charges are and how they are calculated, let us discuss some.

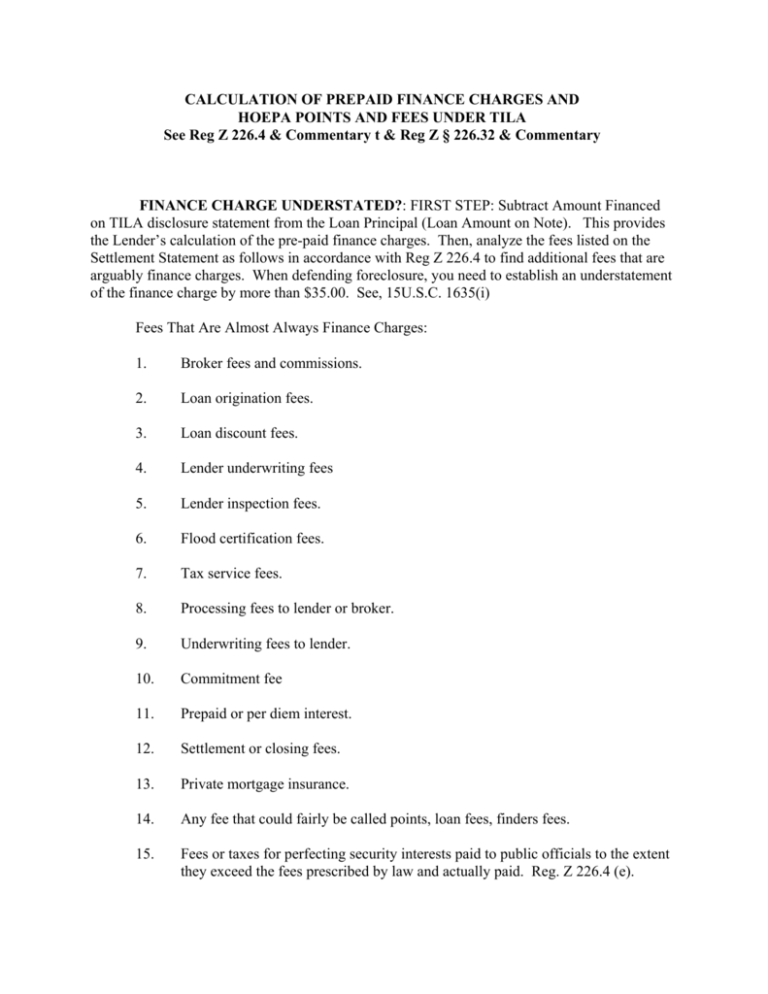

How to reduce finance charges. How to minimize finance charges pay your balances in full the most effective way to avoid finance charges on credit card accounts is to pay off your. But there are also ways to reduce your interest costs significantly as you pay down debt. If you refinance to 4% and keep the.

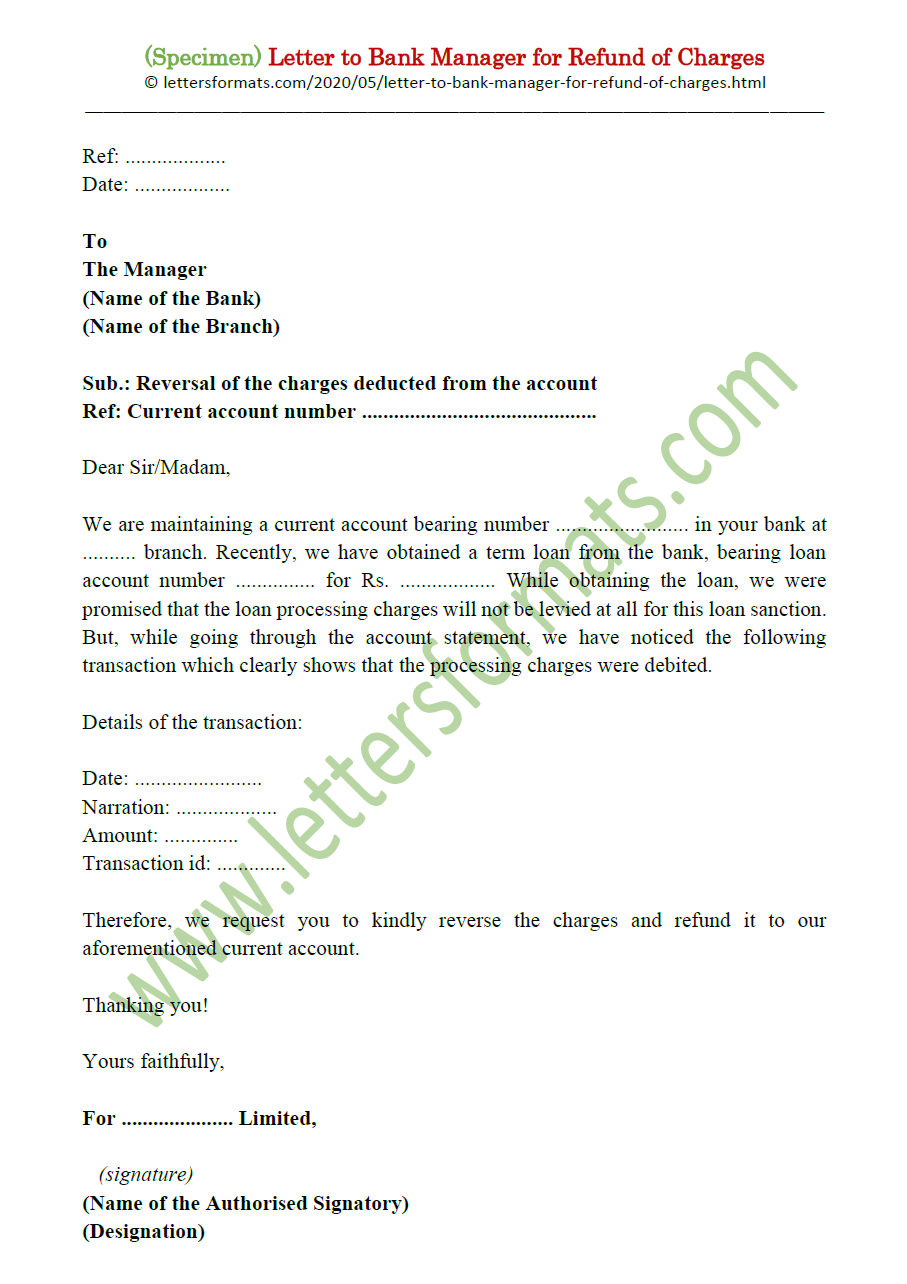

Tips for avoiding or reducing high finance charges on credit cards. The reduction of their points penalty will move everton on to 25 points and up to 15th in the premier league. A larger down payment means you will borrow less money, which can help reduce the total amount of interest you pay over the life of the loan.

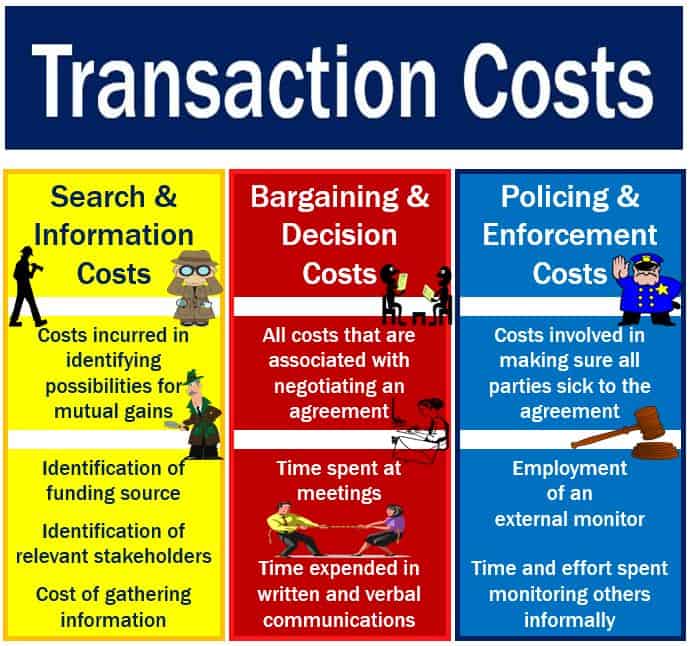

Finance charges can encapsulate all of the costs associated with borrowing money. Credit card interest rates use compounded interest rates according to loan.com's article titled 5 proven tips to reduce card finance charges.

The simplest way to reduce the finance charge is to avoid accruing interest on your balance. Hsbc holdings on wednesday reported a shock $3 billion charge on its stake in a chinese bank amid mounting bad loans in the country, sending the british bank's. To calculate the principal times the interest rate owed each payment, do the following:

Make a larger down payment: Cash app doesn’t charge to send money that is processed within one to three business days, but instant payments have fees ranging between 0.5% and 1.75%. Tips to lower finance charges while some finance charges are unavoidable and part of the loan's cost, the good news is that you can take steps to.

Since finance charges are the credit card issuer's way of charging you for carrying a balance, the simple way to avoid finance charges is to pay your. Refinancing faq car loan calculator managing your auto loan » how to reduce charges on a car loan get car financing even with poor credit. The club called the decision — the biggest in the.

By postponing major purchases, you can reduce your account’s average daily balance, and save significantly on your credit card’s interest charges. Pay off your cards in order of their interest rates. It isn't just planned expenses that impact budgets but also small expenses and hidden fees and charges that eat away at our bank accounts.

For cardholders with “good” credit — a credit score of 620 to 719 — the typical interest rate charged by big banks was about 28 percent, compared with about 18. Personal loans like mortgages, personal loans come with finance charges. Life is busy and we all get caught up.

To convert the apr to a decimal, divide it by 100. These may include prepaid service costs or additional fees incurred later. Divide the value by 12 to get.

Now, let’s discuss ways to minimize finance charges so you keep more money in your pocket. How to avoid or reduce finance charges. For that, you need to pay your outstanding credit balance in full before.