Best Info About How To Increase Your Credit Limit On Cards

Companies such as american express state you should wait six months after opening an account before you put in a request.

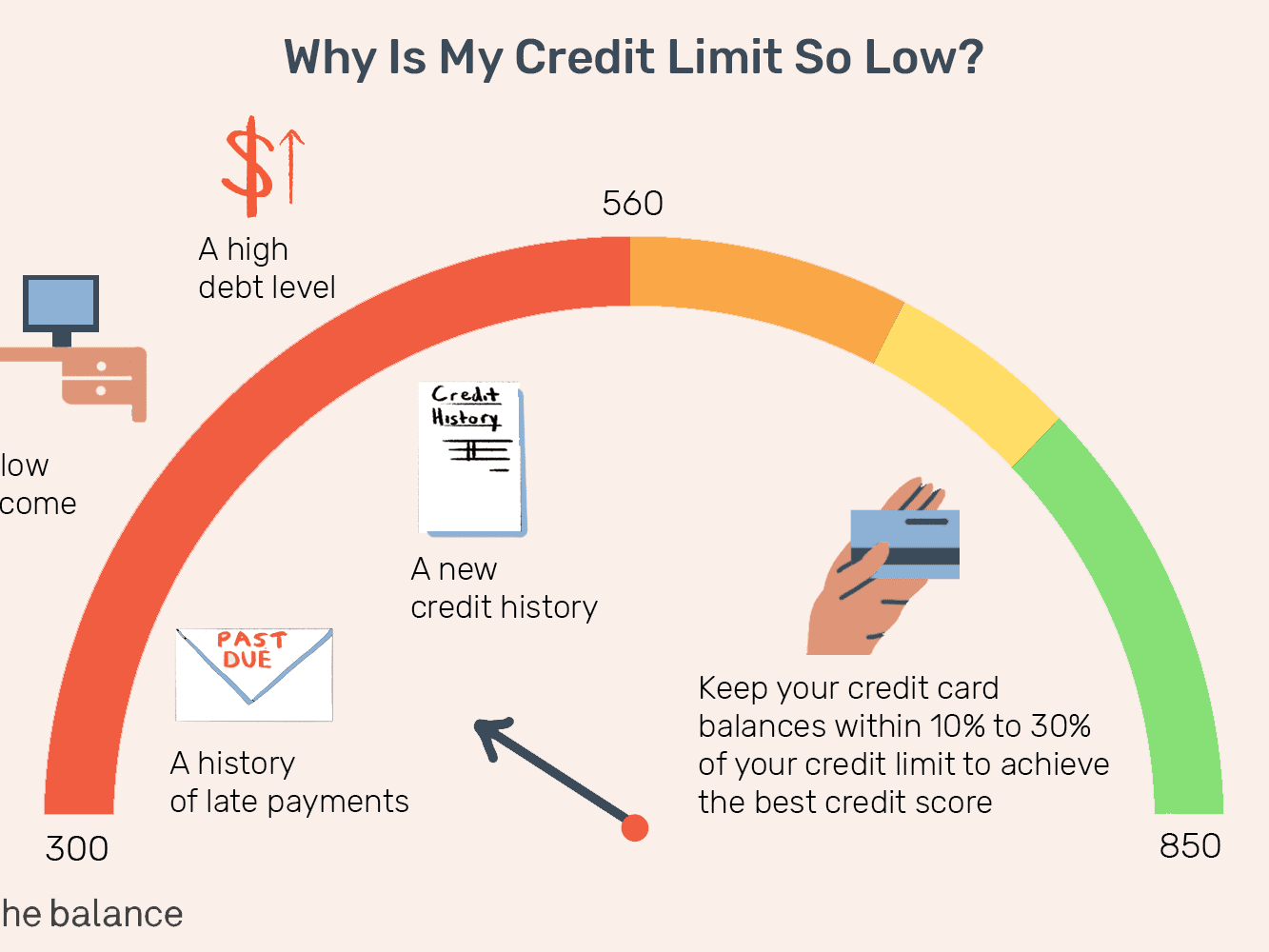

How to increase your credit limit on credit cards. 7, 2022 read time 11 min ever heard of a credit limit? This number represents the total credit americans can. It’s recommended that you have a good or excellent credit score, or a fico score of 670 and up, before asking your issuer for a credit limit increase.

If you need to update the billing information of an existing card, click edit next to the payment method. The credit limit your card comes with defines how much you can spend using your card, and while changing a card’s existing limit is possible, it requires. Many credit card issuers allow their cardholders to ask for a credit limit increase online.

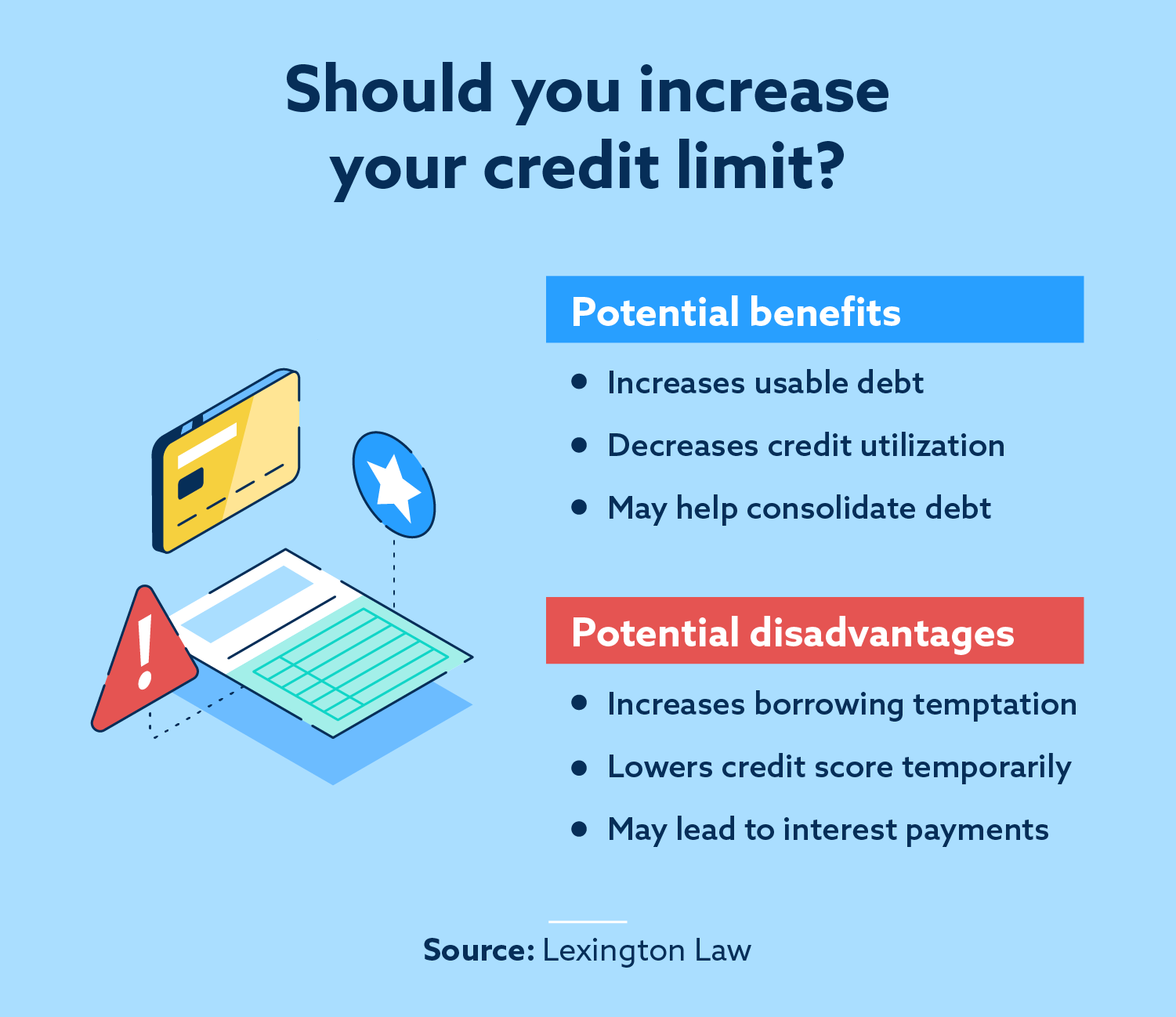

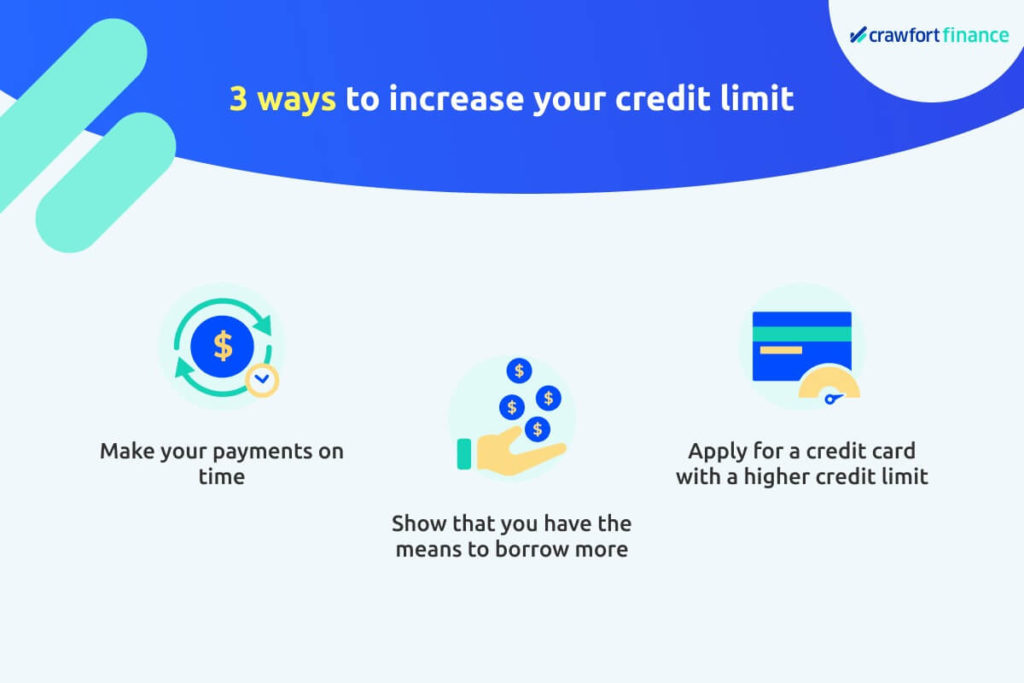

By increasing your credit limit, you can increase your available credit which can lower your credit utilisation ratio and improve your credit score. Enter your new billing information, then click done. If you’re interested in a credit limit increase and haven’t received one automatically, you can always contact your credit card issuer to ask for a credit limit.

Use your card issuer’s online portal or mobile app to request a credit limit increase. The average combined credit limit across each consumer’s credit card accounts was $30,233 in 2021, according to credit bureau experian. Best 0% apr credit cards.

Ask your lender for a lower payment. Cnn underscored money published 3:18 pm edt, mon february 12, 2024 nuttawan jayawan/istock if you’ve been thinking about requesting a credit card limit. Make a request online.

Best credit card welcome bonuses. A credit limit is the maximum amount of money you can spend before you need to pay off some of your. Your credit limit is the maximum balance you can have on your credit card.

The average credit card limit, according to 2021 data from experian, is roughly $30,233 per american. Learn & grow how to increase your credit limit july 31, 2023 | 7 min read if you’ve been using a credit card responsibly, you might be wondering about a credit. If you manage your credit responsibly and make your payments on time, you can increase your credit card limit with time, giving you more flexibility and.

Best balance transfer credit cards. Getting a lower minimum payment on your credit cards may be as simple as asking for it. Make a request online.

Call 1800 801 732 and select option 2. Sign in to your account and look for an option to submit a request. For an example of the latter, i was able to identify the american express.

If you have multiple cards with the. It’s your spending limit determined by your issuer, and it can be increased or. Sign in to your account and submit.