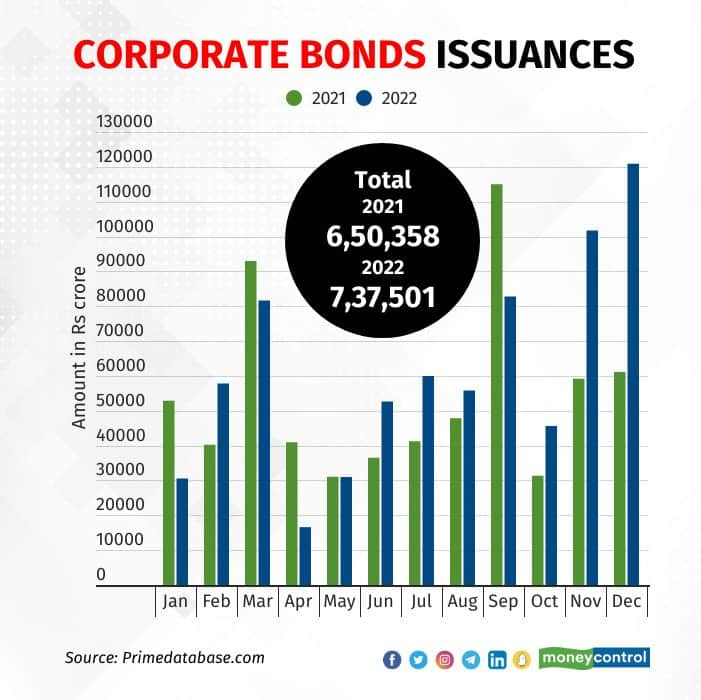

Fantastic Info About How To Buy Uk Corporate Bonds

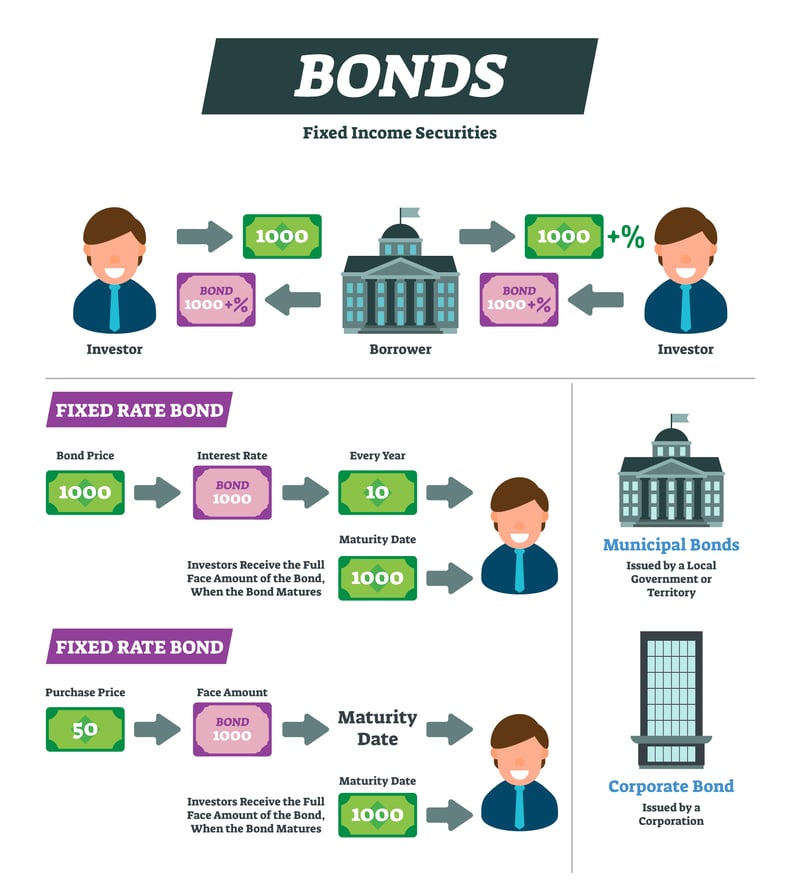

How corporate bonds work.

How to buy uk corporate bonds. Say you want to buy a corporate bond for. You can now also invest in a. If you’re not sure about investing, seek independent advice.

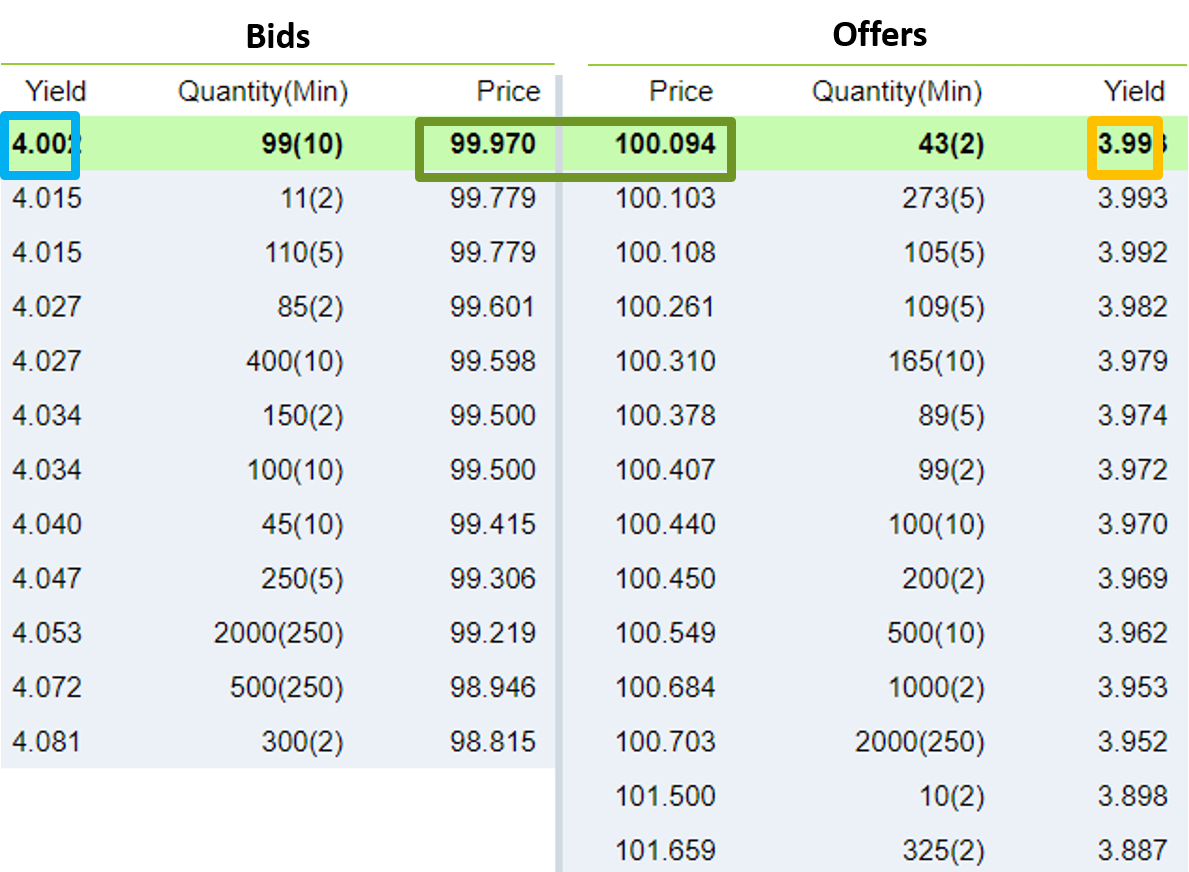

If a uk investor owns bonds that are priced in euros. Also view corporate bonds price charts. Free to access corporate bond prices and information.

Income earned on sterling bond portfolio investments is used to pay for the costs of the bank of england’s. One key consideration when buying bonds is the currency risk. The bank will usually hold two auctions a week, on.

For clarity, the yield on a corporate bond fund is made up of two parts: Buying corporate bonds. In this case, you are the lender, and the borrower is the country or corporation that issues the.

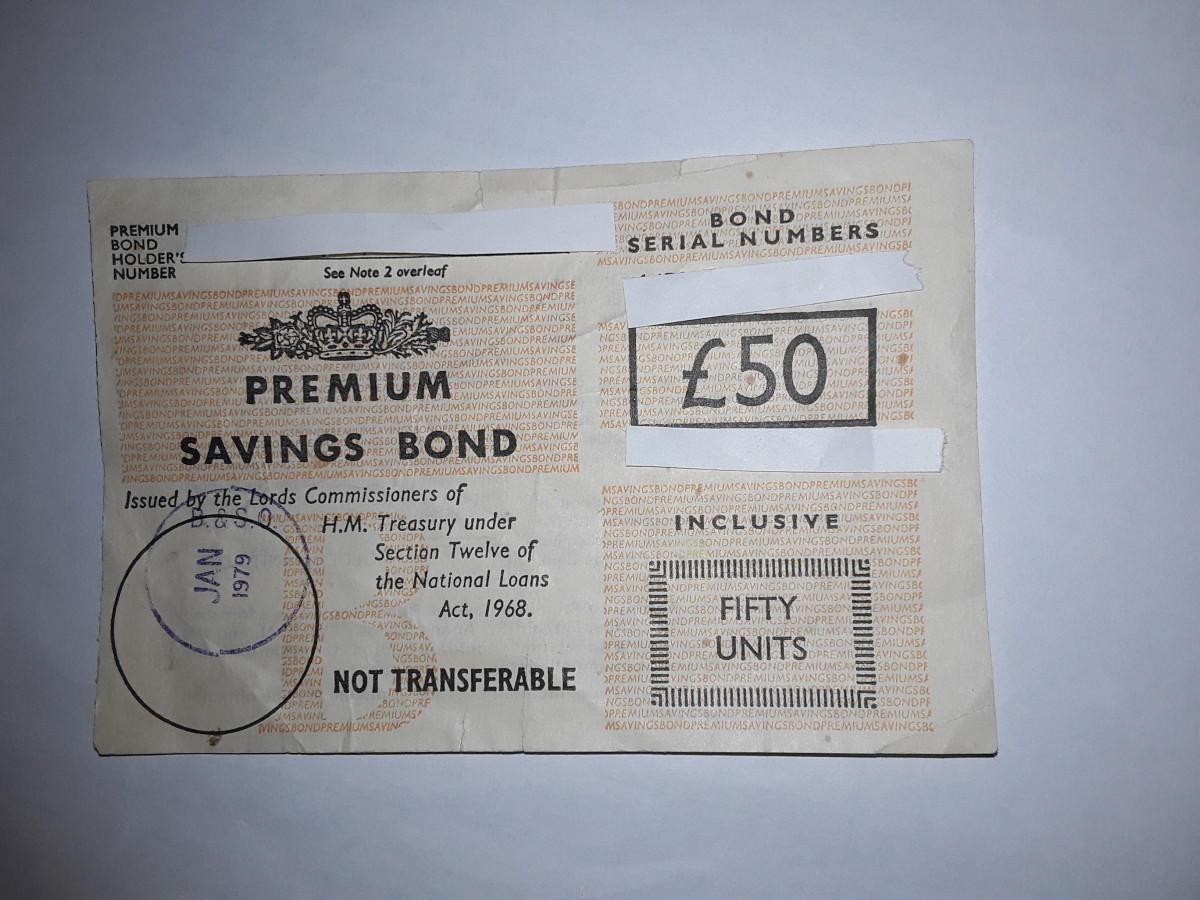

You can also buy gilts. Uk government gilts can be bought directly from hm debt. Achieve net zero emissions associated with the cbps portfolio by 2050.

To buy and sell bonds directly, call our dealing services team on 0345 54 32 600 to access our full range. To invest in the government bond market, you could either buy actual bonds or purchase shares in a bond etf or fund. Intermediate target guiding near term investment.

The bank will look to purchase, via the cbps, an amount of corporate bonds in order to return the aggregate apf stock of corporate bonds up to £20 billion. Vanguard is a pioneer when it comes to passive investing, they created the first retail index fund over 45 years ago.it’s. To understand the characteristics and return of a bond investment, let’s look at a simple example.

True to its name, the. Buying a corporate bond has been made easier in recent years, with many providers now offering an online service. There are several ways to buy corporate bonds in the uk:

You can buy corporate bonds from the london stock exchange's retail bond platform. Uk retail investors will be able to buy gilts at the same price as primary dealers, the latest step aimed at broadening access to government bond markets in. Investing in corporate bonds in the uk.

They require a minimum investment of £1,000. The dealing charge for bonds is £9.95. Uk corporate bonds versus foreign corporate bonds.

-min.png)