Lessons I Learned From Info About How To Be Smart With Your Money

Your heating and air conditioning system is there to keep your home at a comfortable.

How to be smart with your money. Talking about money can feel awkward, uncomfortable, and even scary. How to manage your money better. Start by creating a budget.

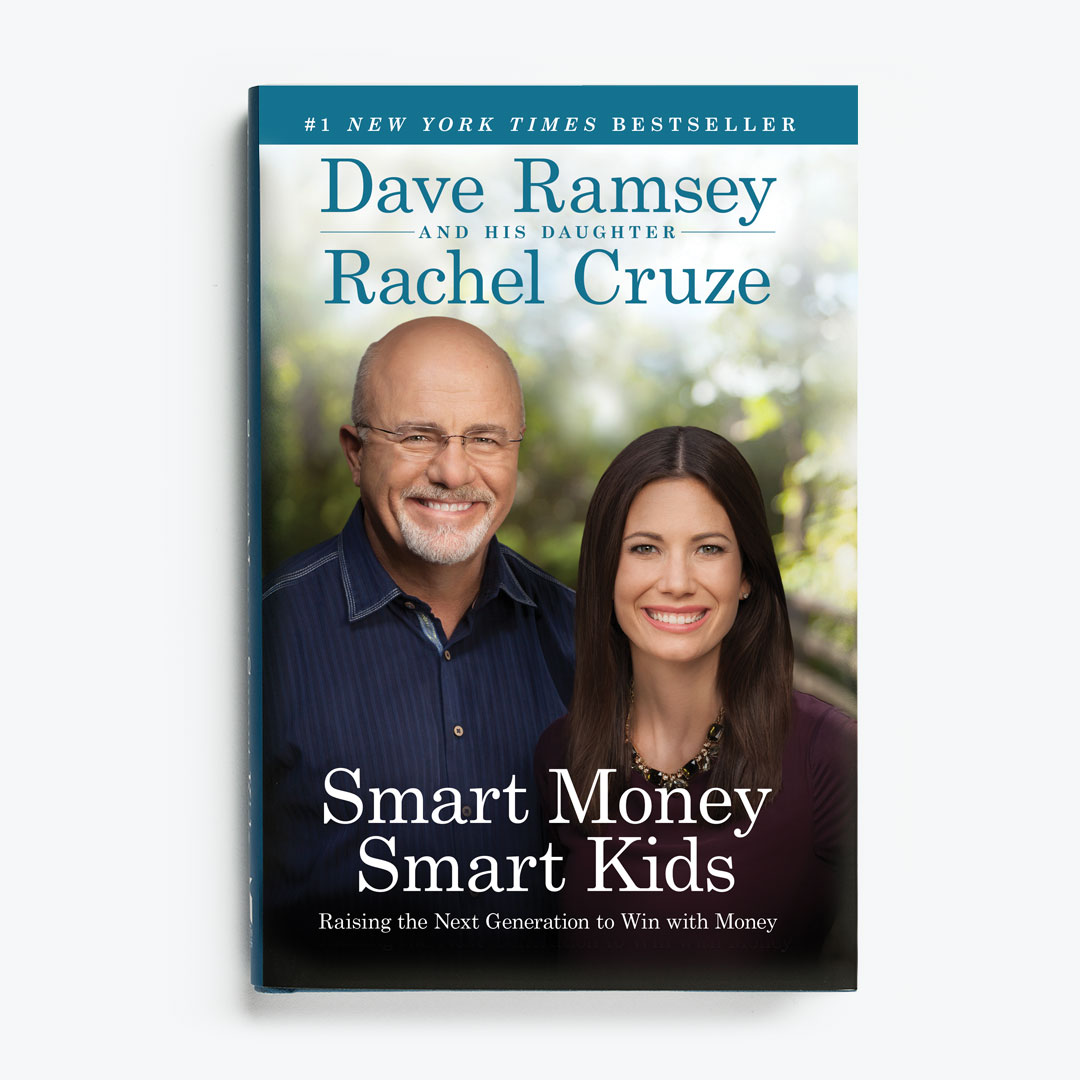

However, that’s not where the real. Here are five pieces of advice. Raise your kids to be money geniuses (and give back too) beth kobliner,.

Avoid being “penny wise but pound foolish” it’s tempting to try saving a couple cents here and there when buying small items. Being smart with your money is about knowing yourself and your strengths and weaknesses, and then setting things up accordingly. Finding a qualified financial advisor doesn't have to be hard.

At a party in a billionaire’s mansion, novelist kurt vonnegut sidles up to fellow. It helps you see where your money is going, makes it. Let’s learn how to be smart with money.

Here’s my favorite of the psychology of money’s nineteen stories: Datalign's free tool matches you with financial advisors in your area in as little as 3. How to be smart with money.

Many people don’t budget because they don’t want to go through what they think will be a boring process of. It shares four money transformations over a year, with the help of different financial. 10 ways to be smarter with your money.

One of the smartest things you can do in order to. Wish you had a bit more left in your bank account at the end of. 12 dec 2019 last updated:

Whether it’s advice on what. It’s about building habits to. To save money and keep you in control, you need a smart ac controller.

Find a qualified financial advisor. A budget is a plan that outlines your income and expenses. Making a budget is the single most useful thing you can do to take control of your money.

By creating a budget, you. But like those who purchased six months earlier, the rate you'll earn on march 1 is now down to 3.94% if you purchased between may and august 2022, or 3.38% if. For example, say that you’re 59, plan to retire in eight years and your 401(k) is invested in an s&p 500 index fund.if the market were to average a 10% annual return.

/Investing-Mistakes-to-Avoid-56a0915e3df78cafdaa2cd4f.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1054017850-7ef42af7b8044d7a86cfb2bff8641e1d.jpg)